Advanced Stock Analysis & AI-Powered Trading Platform

My Role:

AI/ML Researcher, Python Developer, Quantitative Strategy Engineer

Project Timeline:

03/2025 – Present

Technologies:

Python

Pandas

NumPy

Scikit-learn

TensorFlow / Keras / Torch

Transformers (open-source)

TA-Lib

spaCy & NLP

yfinance API

Matplotlib

Seaborn

Streamlit

Relational DB

Led development of a private financial-analytics platform delivering multi-day price forecasts, volume-anomaly filters, and adaptive trading signals across a broad equity universe. Emphasis on scalability, modular experimentation, and interactive visualisation.

Key Contributions & Impact

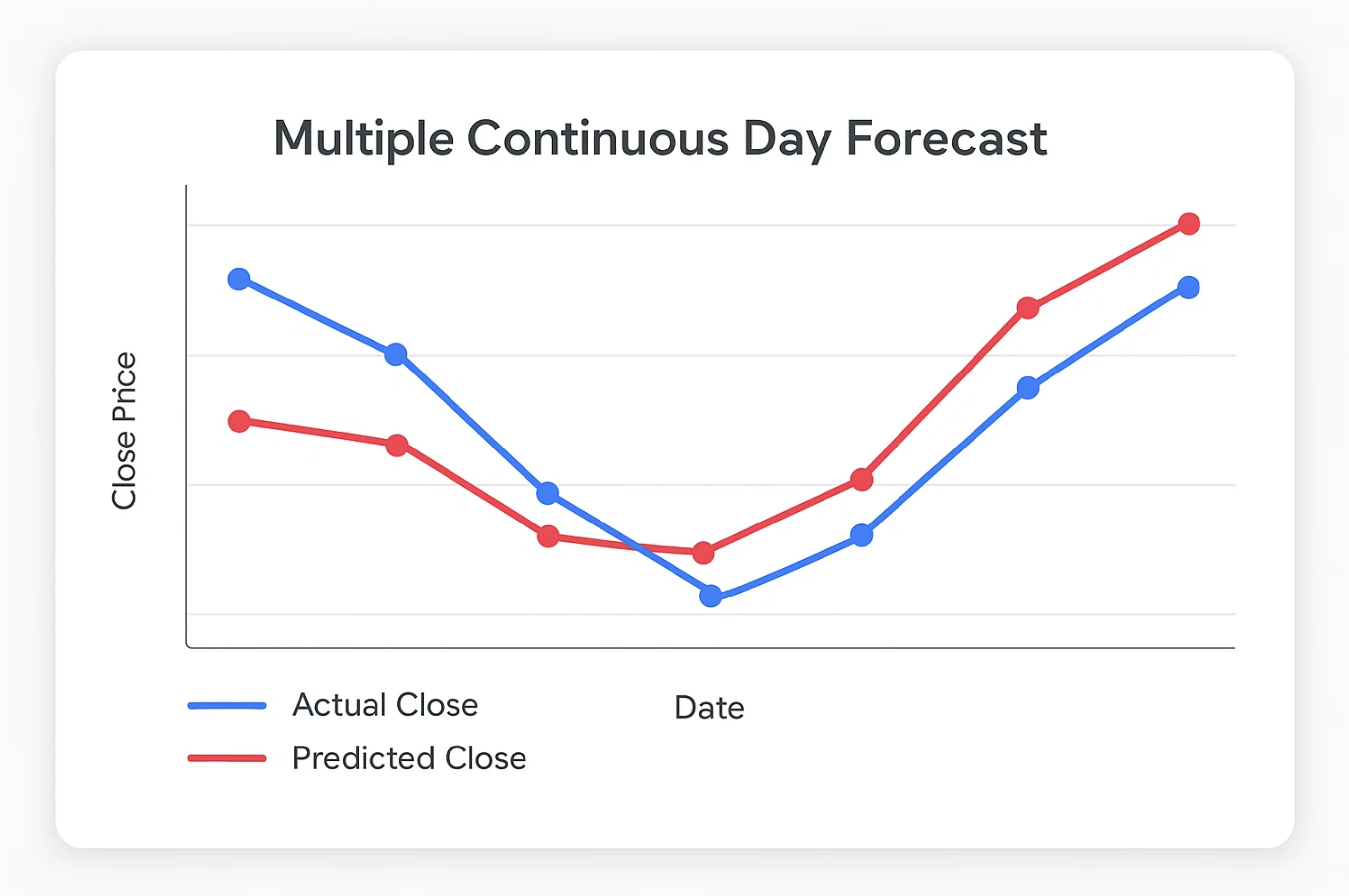

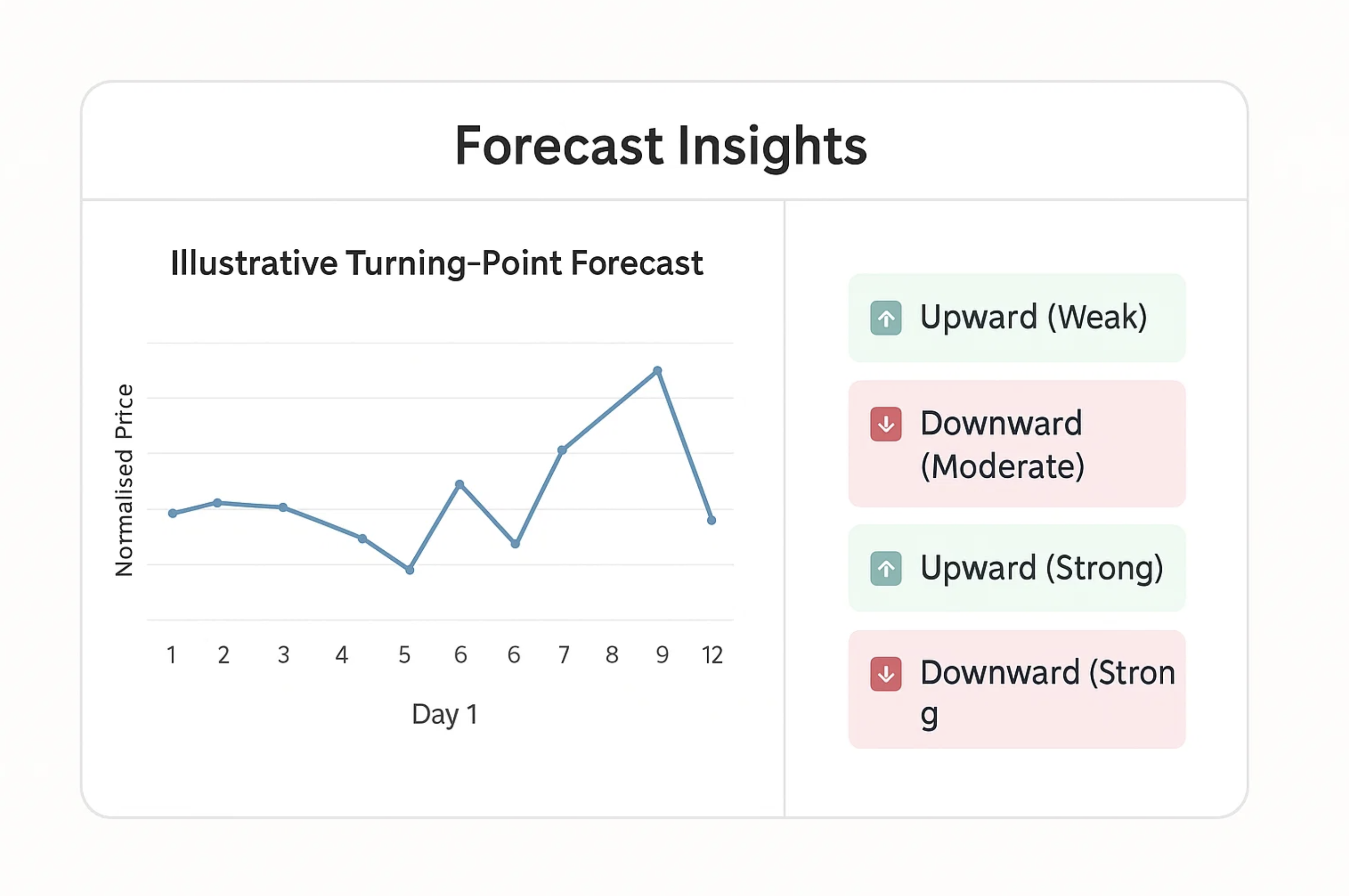

- Multi-Day Forecasting Pipeline: Implemented transformer-based sequence models for multivariate time-series data, achieving consistent out-of-sample error reduction versus baseline methods.

- Volume & Sentiment Filters: Built data-driven modules that combine abnormal-volume detection with high-level market-sentiment scores to improve forecast confidence.

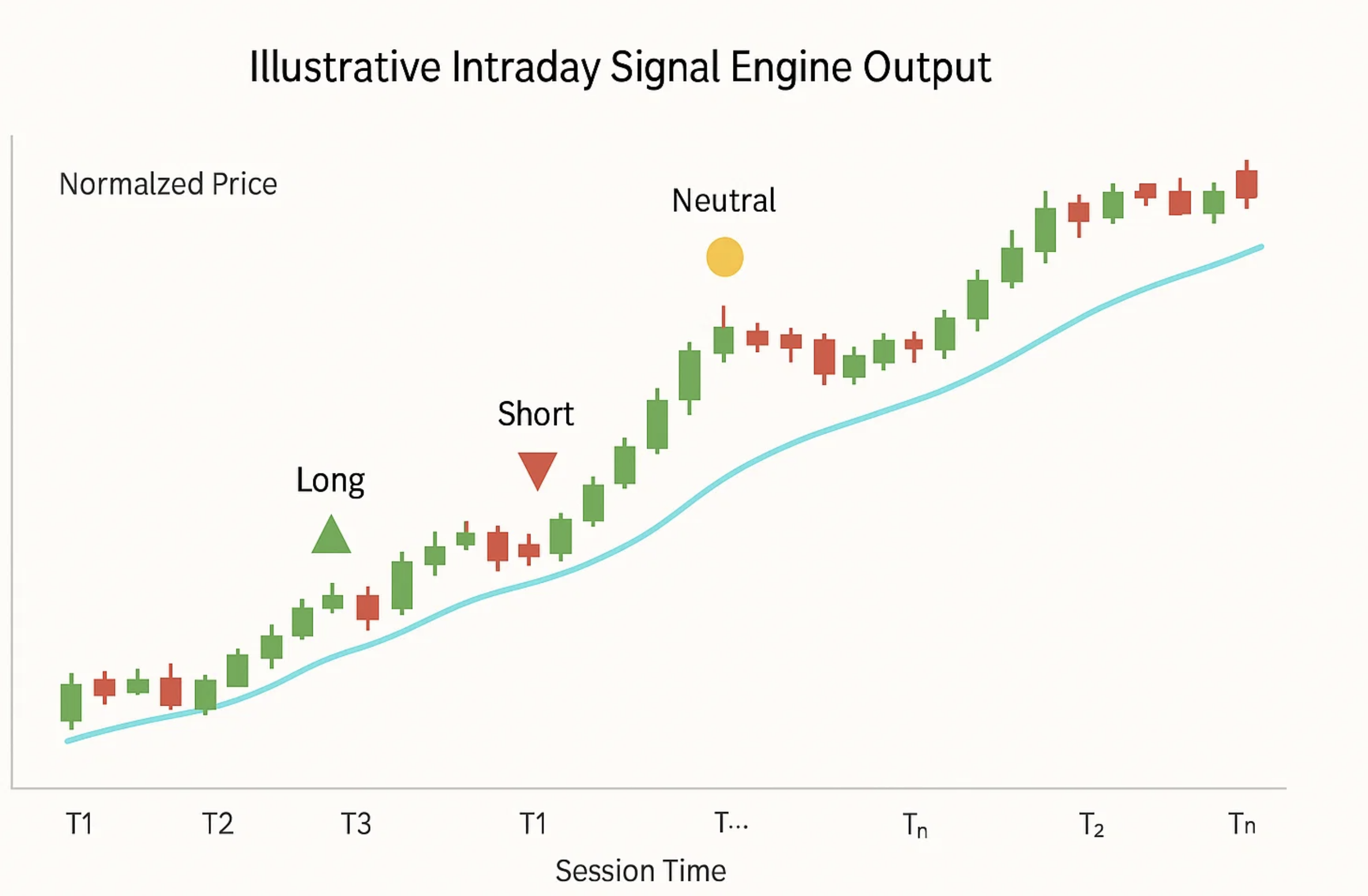

- Adaptive Signal Engine: Integrated technical indicators and ML forecasts inside a rules layer to output dynamic long / neutral / short stances adaptable to multiple intraday intervals.

- System Versatility & Scalability: Engineered the predictive models and trading algorithms to be broadly applicable to a wide range of stocks, not confined to specific tickers, ensuring scalability of the analysis.

- Scalable Data & Visualisation Stack: Automated ingestion of public market data and surfaced insights via a Streamlit dashboard for stakeholders.

Research & Methodology

AI Price Prediction (Multi-Day Horizon)

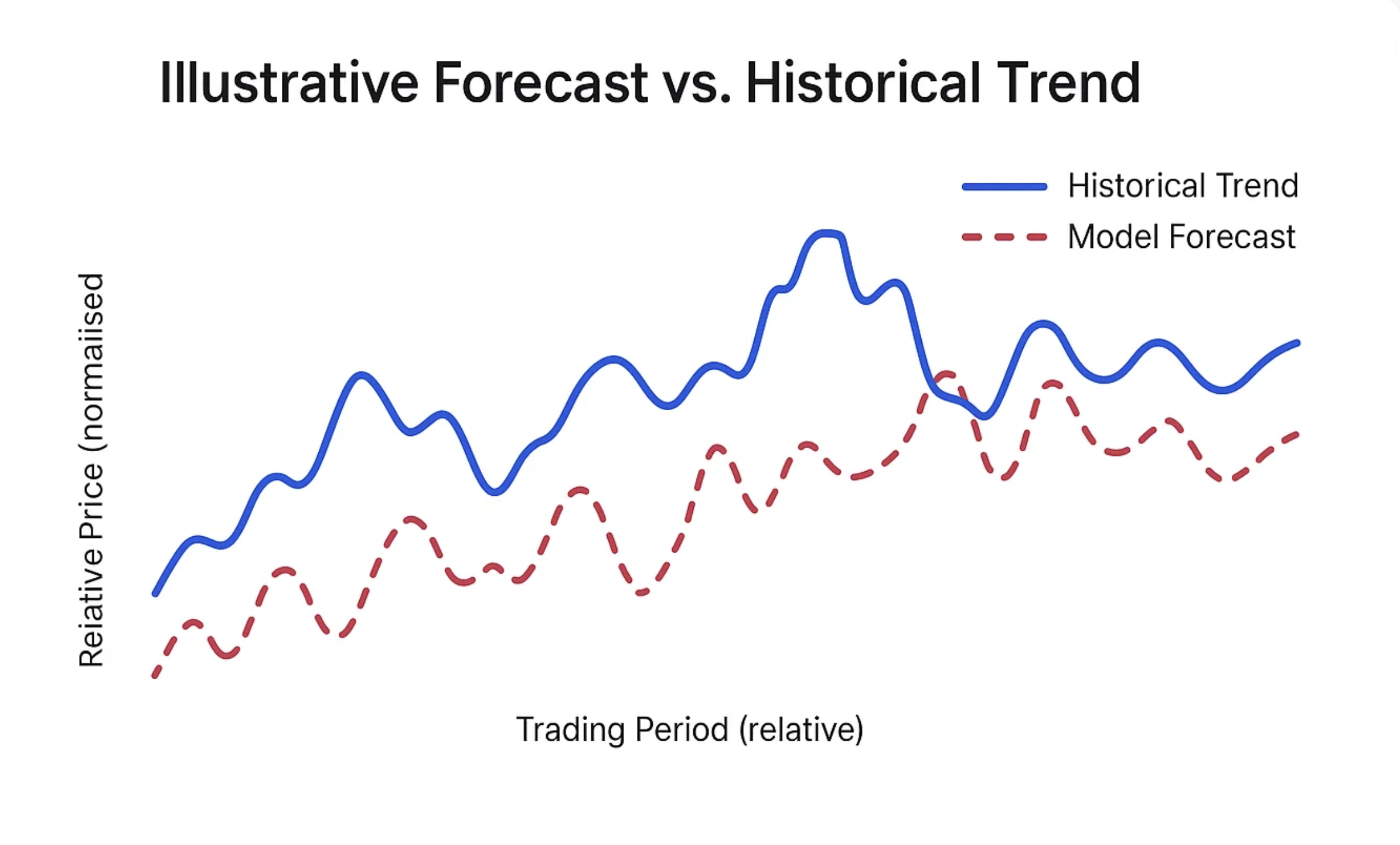

The forecasting module employs open-source transformer architectures adapted for financial time-series.

Illustrative Forecast Visual:

Mock Forecast vs. Historical Trend

Relative Error Distribution

*Charts are synthetic and for demonstration only—no proprietary data displayed.*

Signal Generation Framework

Signals are produced by combining machine-learning forecasts with technical and sentiment factors, refreshed across 5-minute to hourly bars.

*Illustrative mock-up without live trading markers.*

Challenges & Solutions

-

Generalizable AI Models & Algorithms: Ensuring prediction models and trading strategies perform reliably across diverse stocks and evolving market dynamics, rather than being overfit to historical data of a few. Solution: Utilized multi-task learning for AI models to learn shared patterns. Employed robust feature engineering, diverse datasets for training, and rigorous backtesting across various market conditions and stock types. Trading algorithm parameters are designed to be adaptable or self-tuning where possible.

-

Integrating News Sentiment Effectively: Quantifying subjective news data and integrating it meaningfully with quantitative trading signals without introducing excessive noise. Solution:Implemented a weighting or confirmation mechanism where sentiment acts as a filter or a confluence factor alongside TA and BP signals, rather than a primary trigger.

-

Real-time Signal Generation for Day Trading: Processing live market data, news feeds, and executing complex logic with minimal latency to provide timely day trading signals. Solution: Optimized data processing pipelines and algorithmic calculations. Leveraged efficient libraries and focused on computationally feasible models for the real-time components.

Lessons Learned

- Gained deep insights into applying state-of-the-art Transformer models and multi-task learning to complex financial forecasting.

- Developed practical experience in integrating qualitative data like news sentiment with quantitative trading strategies.

- The critical role of adaptable methodologies and rigorous validation (backtesting, out-of-sample testing) in creating trading systems that can generalize to new stocks and market conditions.

- Furthered understanding of market microstructure, including the identification and potential impact of whales activities.